fund launch Services

Quadrangle has facilitated hundreds of fund launches across all structures, strategies, and asset classes. Our legal and business team will ensure you have preferred contract terms, while our proprietary software platform, QDS, manages and tracks all trade and financing, vendor, and company documentation.

The Quadrangle Advantage

- Preferred credit, legal, and economic terms.

- Quantifiable savings of time and money.

- Mitigated legal and economic risk.

- Greater efficiency and business continuity.

SERVICE PROVIDER

SELECTION FOR FUND LAUNCHES

Quadrangle has developed an extensive network of over one thousand relationships across the financial industry, gaining a thorough understanding of the capabilities and needs of its various participants. We have a broad perspective of the vendor and counterparty landscape and can match you with service providers that best fit the needs of your fund launch.

TRADE & FINANCING

AGREEMENT NEGOTIATION

QDS extracts and analyzes trade and financing agreement terms, generating reports that allow you to track terms over time. Our legal and business teams provide the critical service of identifying gaps and negotiating new agreements to achieve preferred terms, focusing on saving money and mitigating risk. We can also assist with selection and onboarding of additional providers as your firm grows post launch.

VENDOR

NEGOTIATION & MANAGEMENT

After uploading your new and existing vendor agreements, Quadrangle extracts and analyzes terms to create term-by-term reports. Our legal and business teams review and negotiate to achieve preferred terms. Manage vendor contracts with notice and renewal dates synced directly with Outlook. Manage vendor relationships through our due diligence module.

REGULATORY ADHERENCE

SUPPORT & ONBOARDING FOR

FUND LAUNCHES

For new and existing regulations, the Quadrangle team can facilitate the adherence process for your fund launch. We also assist with prefilling and review of account opening forms and exchange of KYC documentation.

CLOUD-BASED

DOCUMENT STORAGE

QDS is an information hub that stores, tracks, and manages your trade and financing, vendor, and company documentation, providing secured and on-demand access. Our dynamic dashboards, customized reports and organizational tools create actionable analytics and promote business continuity throughout your fund launch.

A Look Inside: Quadrangle New Hedge Fund Launch Process

With decades of industry experience, Quadrangle is proud to have provided contract management and launch advisory services to a wide variety of hedge fund launches. Contact us today to discuss solutions for your hedge fund launch.

- Quadrangle provides a step-by-step guide on how best to prepare for your fund launch.

- We assist with selection to ensure your service providers best match the needs of your frim, providing introductions and validation when needed.

- Next, we help determine the agreements necessary to trade the asset classes in your book.

- We extract and analyze the terms of your draft trade and financing and vendor agreements, creating term-by-term reports.

- Our legal team then negotiates these agreements to achieve preferred legal, economic, and credit terms.

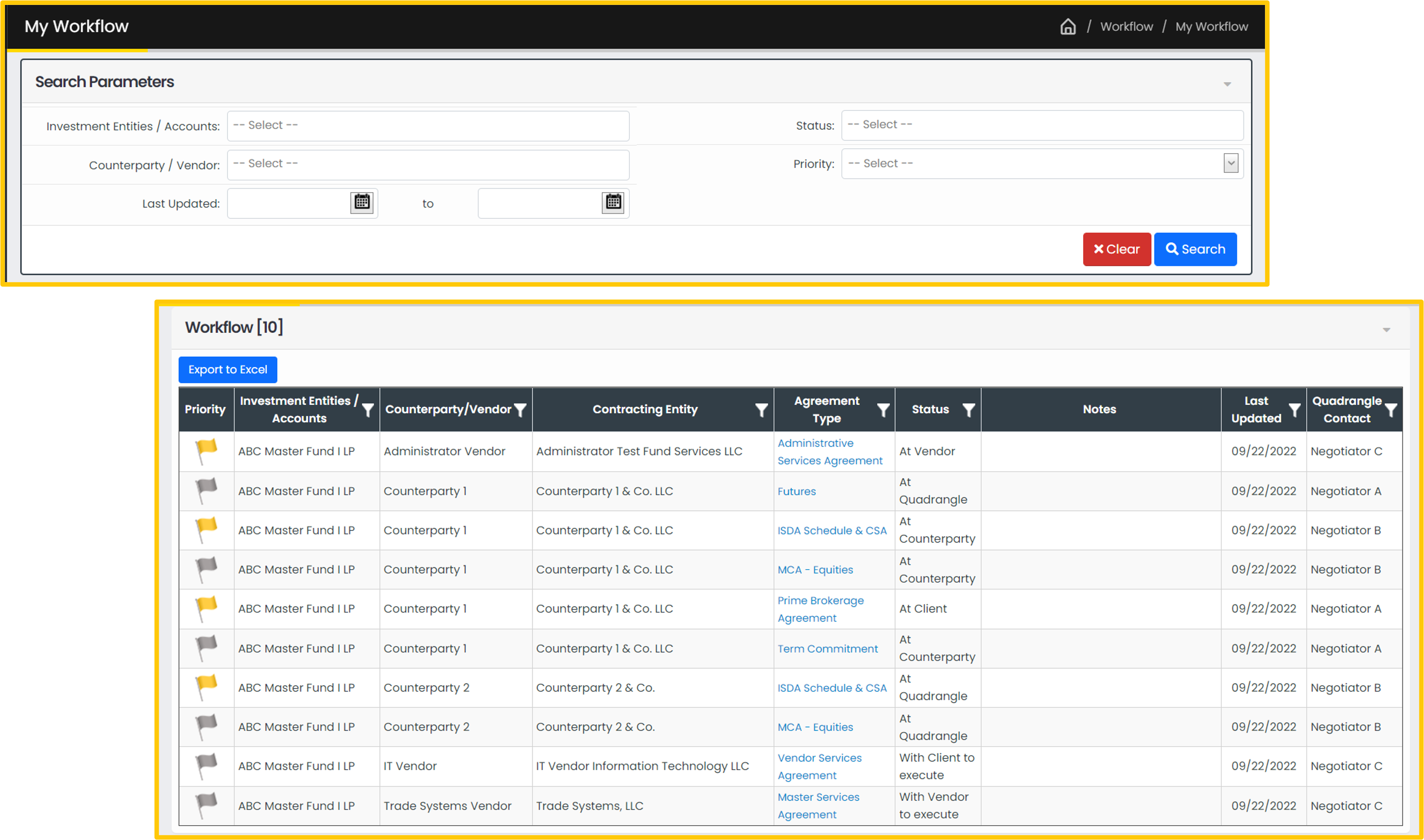

- The status of open matters with Quadrangle are available on our Workflow tool, providing you an accurate, on-demand launch progress report.

- Our business team facilitates onboarding and regulatory adherence to ensure you are prepared for your fund launch.

- Quadrangle is a leading provider of launch advisory, contract negotiation, and vendor management for fund launches in the financial services industry.

Address

185 Hudson Street

Suite 2320

Jersey City, NJ 07302