Industry expertise meets cutting-edge AI-powered technology and data analytics for the investment management industry

Smart Task Prioritization with AI Insights

Data Analytics for Benchmarking

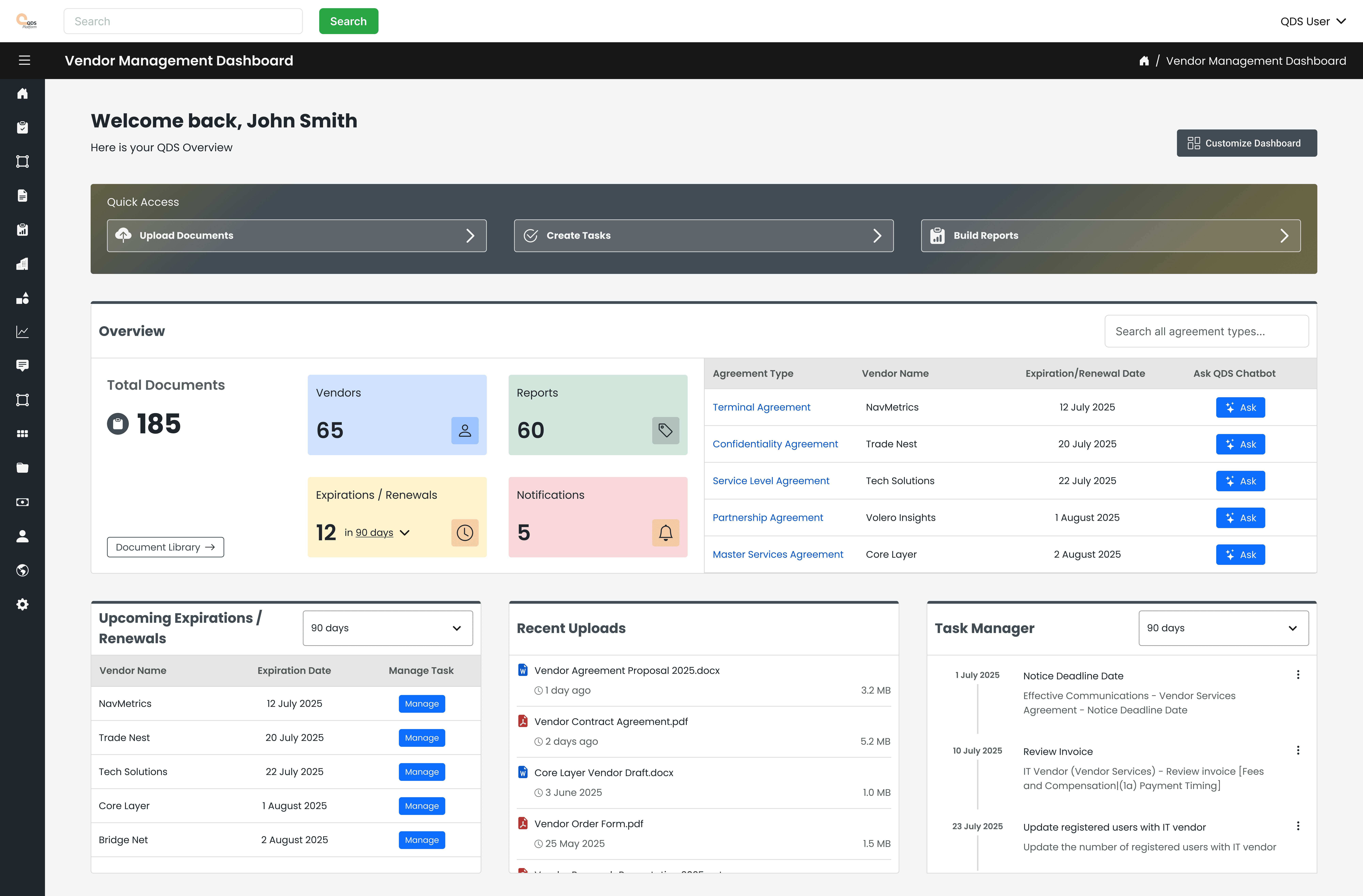

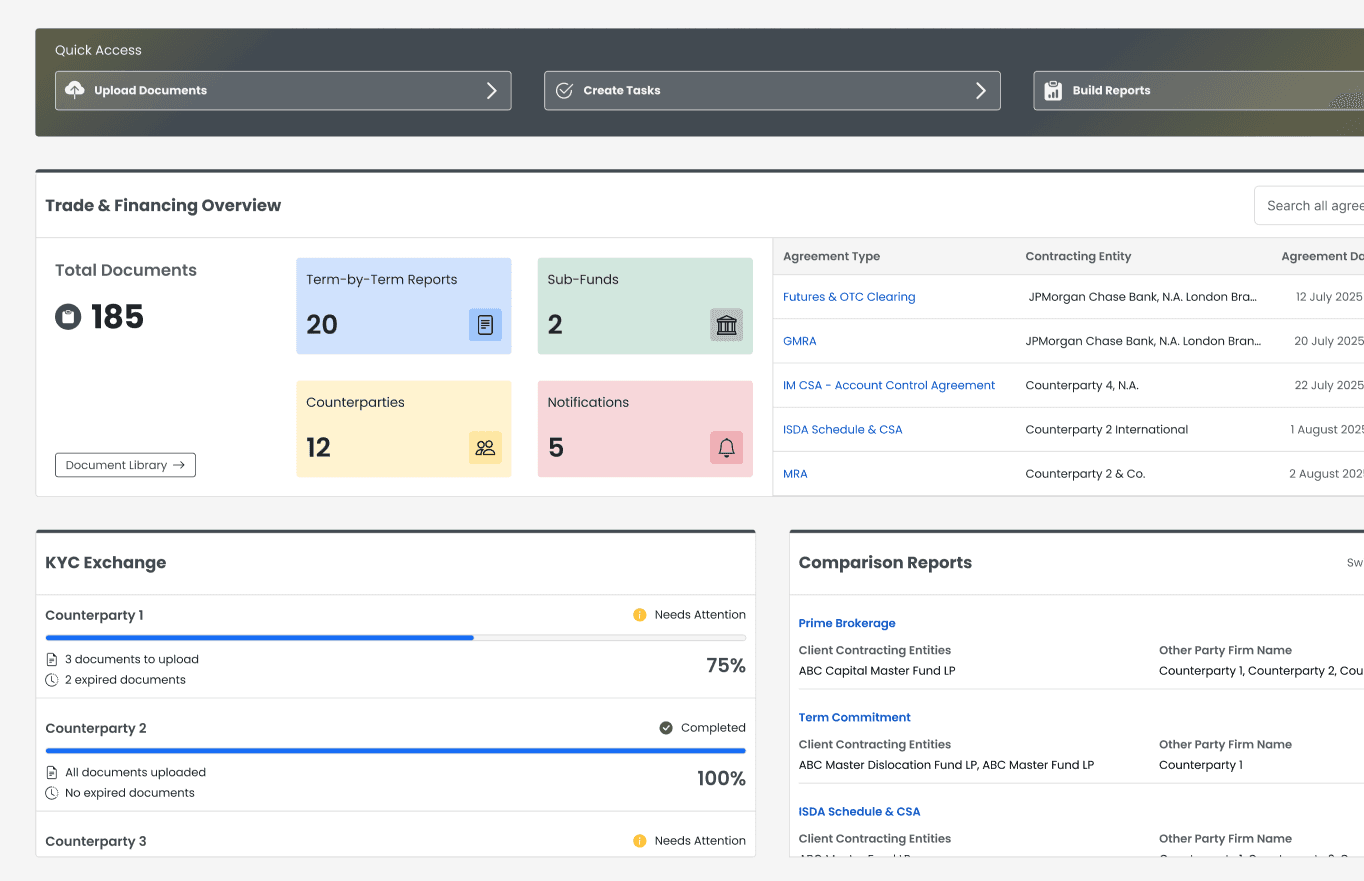

Advanced Contract Management

Secured Data & Document Storage

Smart Reporting

Task Management

Collaboration Tools

Deadline Alerts

Real-Time Sync

Single Source of Truth

Purpose-Built Architecture

Unrivaled Analytics & Benchmarking

Integration & Connectivity Layer

Best-in-class contract technology platform

Institutional legal intelligence

Massive private dataset

Quadrangle’s AI-powered QDS Platform streamlines contract management with data-driven insights and expert legal support. Our technology and legal teams help secure better terms, reduce risk, and boost efficiency. Tailored for financial institutions, QDS enhances contract workflows to fuel business growth.

1

Hedge Funds

For over a decade, Quadrangle has delivered tailored hedge fund solutions—combining legal and financial expertise with technology to improve efficiency, compliance, and strategic decision-making.

2

Fund Launches

3

Private Equity

4

Private Credit

5

Institutional Asset Managers

6

Banks

7

Vendors

8

Real Estate

9

Family Offices

Blogs